Does Wisconsin Tax Military Retirement . Retirement income from defense finance and accounting service or payments related to the coast guard,. Disabled veterans property tax credit. Military retirement system (including payments from. • payments from the u.s. The wisconsin veterans & surviving. All contributions to the thrift savings plan (tsp) are made using. does wisconsin tax military retirement income? You may know that military allowances such as the basic. All retirement payments received from the u.s. state tax breaks available for military and retirees. wisconsin income tax on military retired pay: Military retired pay is not taxed in wisconsin. the following retirement benefits are exempt from wisconsin income tax:

from www.aarp.org

You may know that military allowances such as the basic. state tax breaks available for military and retirees. does wisconsin tax military retirement income? • payments from the u.s. Retirement income from defense finance and accounting service or payments related to the coast guard,. wisconsin income tax on military retired pay: Disabled veterans property tax credit. The wisconsin veterans & surviving. Military retired pay is not taxed in wisconsin. All contributions to the thrift savings plan (tsp) are made using.

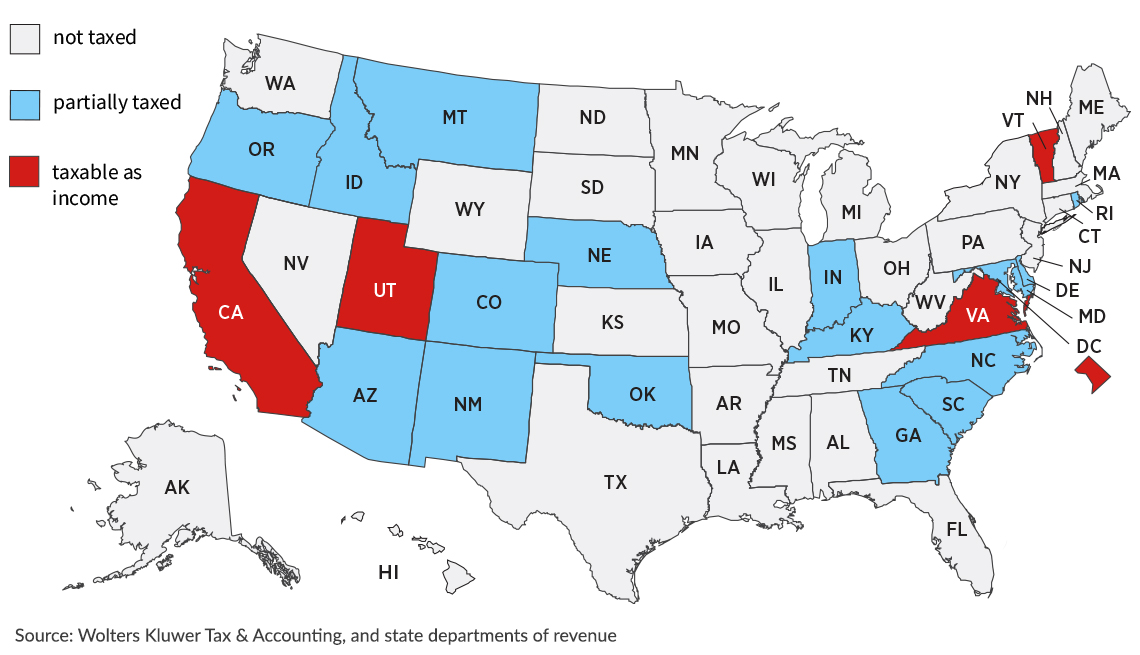

States That Won’t Tax Your Military Retirement Pay

Does Wisconsin Tax Military Retirement The wisconsin veterans & surviving. The wisconsin veterans & surviving. Military retirement system (including payments from. the following retirement benefits are exempt from wisconsin income tax: Disabled veterans property tax credit. wisconsin income tax on military retired pay: • payments from the u.s. All contributions to the thrift savings plan (tsp) are made using. Military retired pay is not taxed in wisconsin. All retirement payments received from the u.s. Retirement income from defense finance and accounting service or payments related to the coast guard,. does wisconsin tax military retirement income? state tax breaks available for military and retirees. You may know that military allowances such as the basic.

From www.veteransunited.com

Which States Do Not Tax Military Retirement? Does Wisconsin Tax Military Retirement wisconsin income tax on military retired pay: Retirement income from defense finance and accounting service or payments related to the coast guard,. Military retirement system (including payments from. Disabled veterans property tax credit. state tax breaks available for military and retirees. Military retired pay is not taxed in wisconsin. The wisconsin veterans & surviving. You may know that. Does Wisconsin Tax Military Retirement.

From www.agingenergized.com

StatebyState Guide to Taxes on Retirees Does Wisconsin Tax Military Retirement state tax breaks available for military and retirees. All contributions to the thrift savings plan (tsp) are made using. Disabled veterans property tax credit. Military retirement system (including payments from. All retirement payments received from the u.s. the following retirement benefits are exempt from wisconsin income tax: You may know that military allowances such as the basic. The. Does Wisconsin Tax Military Retirement.

From vaclaimsinsider.com

Wisconsin Veteran Benefits Guide Does Wisconsin Tax Military Retirement You may know that military allowances such as the basic. • payments from the u.s. the following retirement benefits are exempt from wisconsin income tax: Military retired pay is not taxed in wisconsin. wisconsin income tax on military retired pay: does wisconsin tax military retirement income? All retirement payments received from the u.s. The wisconsin veterans &. Does Wisconsin Tax Military Retirement.

From veteranlife.com

10 Best States for Military Retirement (2023 Edition) Does Wisconsin Tax Military Retirement Military retirement system (including payments from. Retirement income from defense finance and accounting service or payments related to the coast guard,. • payments from the u.s. All contributions to the thrift savings plan (tsp) are made using. wisconsin income tax on military retired pay: Military retired pay is not taxed in wisconsin. All retirement payments received from the u.s.. Does Wisconsin Tax Military Retirement.

From www.pinterest.com

Which States Don't Tax Military Retirement Pay? Military Pension State Does Wisconsin Tax Military Retirement Military retirement system (including payments from. state tax breaks available for military and retirees. Retirement income from defense finance and accounting service or payments related to the coast guard,. wisconsin income tax on military retired pay: does wisconsin tax military retirement income? You may know that military allowances such as the basic. the following retirement benefits. Does Wisconsin Tax Military Retirement.

From www.pinterest.com

StatebyState Guide to Taxes on Retirees Retirement, Retirement Does Wisconsin Tax Military Retirement wisconsin income tax on military retired pay: Military retired pay is not taxed in wisconsin. All retirement payments received from the u.s. does wisconsin tax military retirement income? The wisconsin veterans & surviving. the following retirement benefits are exempt from wisconsin income tax: Disabled veterans property tax credit. • payments from the u.s. All contributions to the. Does Wisconsin Tax Military Retirement.

From www.pinterest.de

StatebyState Guide to Taxes on Retirees Best places to retire Does Wisconsin Tax Military Retirement wisconsin income tax on military retired pay: does wisconsin tax military retirement income? The wisconsin veterans & surviving. Disabled veterans property tax credit. Military retirement system (including payments from. All retirement payments received from the u.s. Retirement income from defense finance and accounting service or payments related to the coast guard,. the following retirement benefits are exempt. Does Wisconsin Tax Military Retirement.

From www.taxdefensenetwork.com

Retiring? These States Won't Tax Your Distributions Does Wisconsin Tax Military Retirement Disabled veterans property tax credit. wisconsin income tax on military retired pay: does wisconsin tax military retirement income? Military retirement system (including payments from. the following retirement benefits are exempt from wisconsin income tax: • payments from the u.s. You may know that military allowances such as the basic. The wisconsin veterans & surviving. Retirement income from. Does Wisconsin Tax Military Retirement.

From retiregenz.com

How Does Military Retirement Work? Retire Gen Z Does Wisconsin Tax Military Retirement All contributions to the thrift savings plan (tsp) are made using. You may know that military allowances such as the basic. Military retired pay is not taxed in wisconsin. Retirement income from defense finance and accounting service or payments related to the coast guard,. the following retirement benefits are exempt from wisconsin income tax: wisconsin income tax on. Does Wisconsin Tax Military Retirement.

From www.aarp.org

States That Won’t Tax Your Military Retirement Pay Does Wisconsin Tax Military Retirement wisconsin income tax on military retired pay: You may know that military allowances such as the basic. Military retired pay is not taxed in wisconsin. the following retirement benefits are exempt from wisconsin income tax: All retirement payments received from the u.s. All contributions to the thrift savings plan (tsp) are made using. Retirement income from defense finance. Does Wisconsin Tax Military Retirement.

From www.ktoo.org

States Compete for Military Retirees Does Wisconsin Tax Military Retirement Retirement income from defense finance and accounting service or payments related to the coast guard,. All contributions to the thrift savings plan (tsp) are made using. Military retirement system (including payments from. • payments from the u.s. Military retired pay is not taxed in wisconsin. does wisconsin tax military retirement income? All retirement payments received from the u.s. . Does Wisconsin Tax Military Retirement.

From wisevoter.com

Retirement Taxes by State 2023 Wisevoter Does Wisconsin Tax Military Retirement wisconsin income tax on military retired pay: Military retirement system (including payments from. Disabled veterans property tax credit. Military retired pay is not taxed in wisconsin. does wisconsin tax military retirement income? All contributions to the thrift savings plan (tsp) are made using. All retirement payments received from the u.s. state tax breaks available for military and. Does Wisconsin Tax Military Retirement.

From www.aarp.org

States That Won’t Tax Your Military Retirement Pay Does Wisconsin Tax Military Retirement You may know that military allowances such as the basic. the following retirement benefits are exempt from wisconsin income tax: state tax breaks available for military and retirees. does wisconsin tax military retirement income? The wisconsin veterans & surviving. All contributions to the thrift savings plan (tsp) are made using. wisconsin income tax on military retired. Does Wisconsin Tax Military Retirement.

From www.pinterest.co.uk

Military Retirement Taxes by State Which States Don't Tax Does Wisconsin Tax Military Retirement Disabled veterans property tax credit. state tax breaks available for military and retirees. All contributions to the thrift savings plan (tsp) are made using. • payments from the u.s. Military retirement system (including payments from. does wisconsin tax military retirement income? the following retirement benefits are exempt from wisconsin income tax: Retirement income from defense finance and. Does Wisconsin Tax Military Retirement.

From www.youtube.com

How WISCONSIN Taxes Retirees YouTube Does Wisconsin Tax Military Retirement You may know that military allowances such as the basic. Retirement income from defense finance and accounting service or payments related to the coast guard,. All contributions to the thrift savings plan (tsp) are made using. The wisconsin veterans & surviving. • payments from the u.s. Military retired pay is not taxed in wisconsin. does wisconsin tax military retirement. Does Wisconsin Tax Military Retirement.

From www.slideteam.net

State Tax Military Retirement In Powerpoint And Google Slides Cpb Does Wisconsin Tax Military Retirement All contributions to the thrift savings plan (tsp) are made using. All retirement payments received from the u.s. the following retirement benefits are exempt from wisconsin income tax: Military retirement system (including payments from. Disabled veterans property tax credit. state tax breaks available for military and retirees. You may know that military allowances such as the basic. The. Does Wisconsin Tax Military Retirement.

From www.retireguide.com

The 5 Best and Worst States to Retire in 2023 Does Wisconsin Tax Military Retirement does wisconsin tax military retirement income? Military retirement system (including payments from. The wisconsin veterans & surviving. You may know that military allowances such as the basic. Retirement income from defense finance and accounting service or payments related to the coast guard,. Military retired pay is not taxed in wisconsin. the following retirement benefits are exempt from wisconsin. Does Wisconsin Tax Military Retirement.

From www.militarybyowner.com

Planning Ahead for Military Retirement MilitaryByOwner Does Wisconsin Tax Military Retirement wisconsin income tax on military retired pay: All contributions to the thrift savings plan (tsp) are made using. Disabled veterans property tax credit. Military retirement system (including payments from. does wisconsin tax military retirement income? Retirement income from defense finance and accounting service or payments related to the coast guard,. state tax breaks available for military and. Does Wisconsin Tax Military Retirement.